Key Takeaways

-

Bitcoin mining accelerates renewable energy adoption by consuming surplus power and reducing waste.

-

Compared to gold, Bitcoin is less polluting and offers financial utility rather than sitting idle in vaults.

-

Mining upgrades after halvings improve efficiency but also raise e-waste concerns.

-

Bitcoin stabilizes the grid by absorbing excess energy and shutting down during peak demand.

-

Miners help avoid fossil fuel expansion, saving Texas $18 billion in gas plant costs.

-

Bitcoin captures wasted energy, reducing emissions from gas flaring and methane leaks.

-

Bitcoin’s Proof of Work (PoW) mechanism has led to rapid improvements in mining efficiency, reducing energy consumption per computational output by 63% in five years.

Bitcoin and Energy: A Catalyst for Sustainability or an Environmental Threat?

Bitcoin’s energy consumption has been a focal point of debate, often criticized for its substantial electricity usage. However, the Bitcoin energy impact goes beyond raw energy consumption—it is driving innovation in renewable energy, improving grid efficiency, and offering financial inclusion to many around the world. Contrary to common misconceptions, Bitcoin mining is increasingly powered by sustainable energy sources, making it a potential catalyst for the global energy transition.

This article delves into the nuances of Bitcoin energy impact, its role in the financial system, and how it contributes to a more sustainable future.

Bitcoin: An Energy Revolution

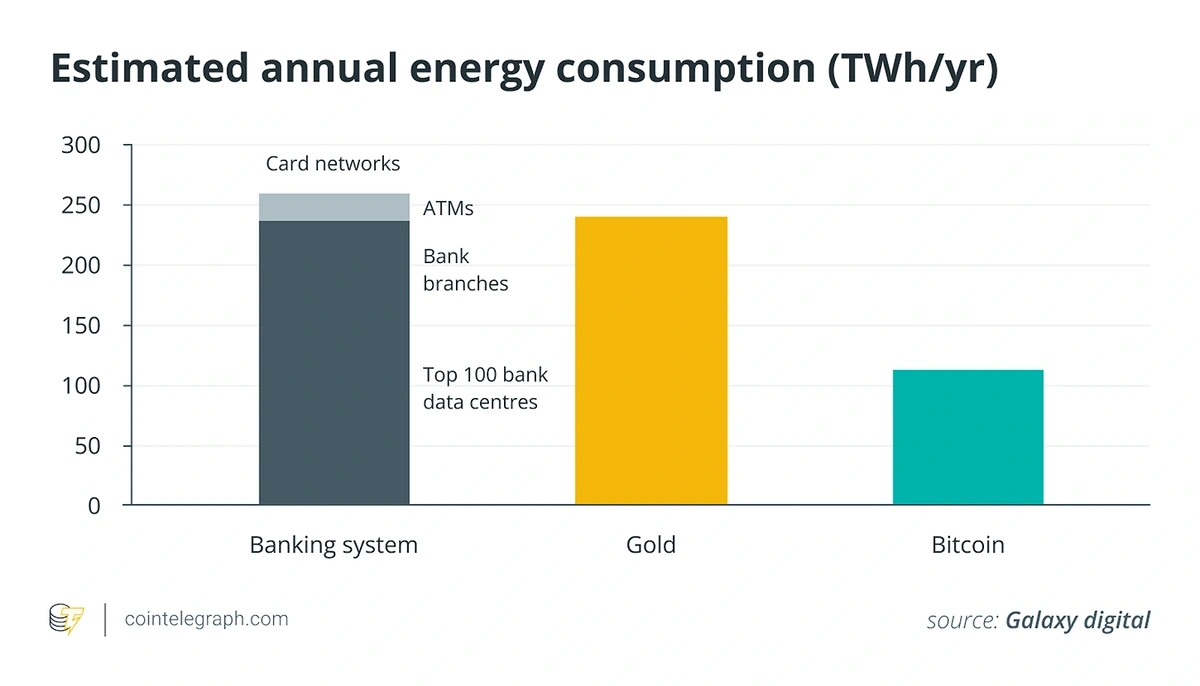

At first glance, Bitcoin’s energy consumption appears counterintuitive to environmental sustainability. Yet, this substantial energy use can drive advancements in renewable energy integration and grid stability. As highlighted by Bloomberg, the traditional monetary system is one of the most significant environmental disruptors created by humanity (as shown on the graph below).

Bitcoin’s Proof of Work (PoW) mechanism requires computational power, leading miners to seek the cheapest and often surplus energy sources, including renewables. This dynamic has incentivized investments in sustainable energy projects, making Bitcoin a potential accelerator of the green transition rather than a threat to it.

Inflation and Bitcoin as a Store of Value

Inflation erodes the purchasing power of traditional fiat currencies, prompting individuals to seek assets that preserve value over time. In countries experiencing hyperinflation, such as Venezuela, citizens have turned to Bitcoin as a hedge against currency devaluation. Unlike fiat currencies, Bitcoin’s supply is capped at 21 million coins, making it a deflationary asset by design.

Similarly, gold, another traditional store of value, involves energy-intensive and environmentally taxing extraction processes, only to be stored in central bank vaults. Bitcoin is often criticized for its energy consumption, but as as the graph below shows, gold mining is even more polluting. Gold mining and its equipment consume significantly more energy (159.69 million kWh) than Bitcoin mining (105.82 million kWh) and produce higher CO₂ emissions.

Despite this impact, gold is primarily stored in central bank vaults, generating no additional value beyond being a reserve asset. In contrast, Bitcoin operates as a global financial network, offering an alternative monetary system that is increasingly powered by renewable energy.

This comparison highlights that while Bitcoin does consume energy, its long-term utility and growing sustainability efforts set it apart from traditional, highly polluting industries like gold mining. Bitcoin offers a digital alternative that eliminates the need for physical extraction and storage, potentially reducing the environmental impact associated with maintaining a store of value.

It’s worth noting that the energy consumption figure for Bitcoin mining does not account for the production and recycling of mining equipment, while gold mining includes energy used for both extraction and equipment.

source : mdpi.com

source : mdpi.com

For your information, after each Bitcoin halving, miners must upgrade their hardware to remain profitable. With block rewards now at 3.125 BTC, older ASICs become less viable due to lower efficiency and higher energy costs. Many miners sell outdated models to regions with cheaper electricity or recycle components. However, a large portion ends up as e-waste, raising concerns about sustainability. The shift to new-generation miners like the Bitmain S21 ensures competitiveness, but also accelerates hardware turnover in the industry.

The Necessity of Proof of Work

The Proof of Work (PoW) consensus mechanism is the cornerstone of Bitcoin’s security and decentralization. By requiring miners to perform complex cryptographic computations, it ensures that attacking the network is not only technically difficult but also economically prohibitive. While this process is energy-intensive, it is what guarantees the integrity and trustworthiness of the blockchain.

A frequent critique of PoW is its energy consumption, often seen as excessive. However, this cost is not a flaw but a feature, essential to securing a global, decentralized financial system. More importantly, the pursuit of greater efficiency has driven rapid advancements in mining hardware, significantly reducing the energy required per unit of computational power.

In July 2018, Bitcoin miners operated with an average efficiency of 89 joules per terahash (J/TH). By May 2023, this figure had improved to 33 J/TH, marking a 63% reduction in energy consumption for the same level of computational output. This remarkable progress is attributed to the continuous evolution of ASIC (Application-Specific Integrated Circuit) miners, with models like the Bitmain Antminer S19 XP and MicroBT M50 delivering nearly twice the efficiency of earlier generations.

Far from being static, the PoW mechanism incentivizes technological progress, ensuring that Bitcoin mining becomes not only more secure but also more energy-efficient over time. As innovation in mining hardware continues, the network strengthens while minimizing its environmental impact—challenging the notion that security must come at an unsustainable cost.

Proof of Stake: An Alternative Consensus Mechanism

The Proof of Stake (PoS) mechanism, adopted by cryptocurrencies like Ethereum, offers an energy-efficient alternative to PoW. PoS reduces energy consumption by requiring validators to hold and “stake” their coins as collateral to validate transactions, rather than performing energy-intensive computations.

However, PoS has its own set of challenges. It can lead to centralization, as entities with more significant holdings have more influence over the network. Additionally, PoS is less battle-tested than PoW, and its security model relies on economic incentives rather than computational work, which may have different implications for network security.

Bitcoin energy Consumption in Perspective

To put Bitcoin’s energy impact into perspective, consider this: holiday lights in the United States consume more electricity during the festive season than the entire Bitcoin network over the same period. Yet, this rarely makes headlines. Instead, Bitcoin’s energy consumption is often compared to that of entire countries, ignoring crucial nuances such as energy sources, efficiency improvements, and the broader benefits the network provides.

A common misconception is that Bitcoin competes with household energy use, but in reality, miners seek the cheapest electricity, often utilizing surplus or stranded energy that would otherwise go to waste. This not only prevents energy loss but also enhances grid stability. In many cases, energy producers generate excess power during off-peak hours that cannot be efficiently stored—Bitcoin miners act as a flexible demand source, absorbing this surplus and providing a consistent revenue stream that incentivizes further renewable energy development.

In Texas, “demand response” programs take this a step further, where miners voluntarily shut down during peak demand, freeing up electricity for critical uses and reinforcing grid reliability. This flexibility makes Bitcoin mining unique compared to other energy-intensive industries, which cannot power down as easily. On top of that, here is a graph showing that Bitcoin is making more of an effort than other industries when it comes to the climate, as shown in this chart Comparing Bitcoin Mining to other Industries’ energy mix.

Source : Batcoinz

Beyond energy optimization, the blockchain is also transforming carbon credit markets by leveraging its transparency and security. Decentralized ledgers enable better tracking, verification, and trading of carbon credits, reducing fraud and improving accountability in global sustainability efforts.

➡ Discover how blockchain could revolutionize carbon credits by clicking here.

Innovations in Mining: Gas Flaring and Off-Grid Solutions

Gas flaring, the process of burning off excess natural gas during oil extraction, contributes approximately 400 million tons of CO₂ emissions annually, surpassing the annual emissions of countries like France or Italy. Bitcoin mining could present a solution by capturing this otherwise wasted energy to power mining operations. By converting flared gas into electricity for mining, operators could reduce emissions and generate additional revenue.

Off-grid mining initiatives, such as the hydroelectric-powered operations in the Virunga National Park in the Democratic Republic of Congo, exemplify how Bitcoin mining can support sustainable energy projects. Faced with financial challenges due to regional instability and declining tourism, the park leveraged its hydroelectric infrastructure to mine Bitcoin, generating essential funds to sustain conservation efforts and local communities.

Photo of the Virunga National park – Source : evenaos.fr

Bitcoin and the Accelerated Energy Transition

The Bitcoin energy impact goes beyond its electricity consumption, as it plays a significant role in accelerating the transition to renewable energy. One of the key challenges for renewable energy projects is the long interconnection queues to the grid, which can delay the deployment of clean energy for up to 15 years. Bitcoin mining helps alleviate this issue by acting as a flexible buyer of stranded energy, allowing producers to monetize excess energy immediately, bypassing long wait times for grid approval. This not only accelerates the adoption of renewable energy but also ensures that energy generation becomes profitable right from the start.

Moreover, Bitcoin mining plays a crucial role in reducing wasted energy. In regions like Texas, where excess wind and solar energy often go unused, Bitcoin mining absorbs this energy, helping to avoid costly curtailment. In fact, Bitcoin miners have been able to reduce curtailment by 4% and increase the profitability of renewable energy by 12%, thereby improving the overall efficiency of the grid.

Another significant contribution of Bitcoin mining is in shortening the payback periods for renewable energy projects. By providing a steady demand for energy, Bitcoin mining has helped reduce the payback period for solar and wind facilities from 8.1 years to just 3.5 years, making these projects far more attractive to investors and speeding up the transition to clean energy.

Finally, Bitcoin mining provides demand flexibility, which is critical for balancing the grid as renewable energy sources like solar and wind are intermittent. Miners can scale up operations when there is surplus energy and reduce their consumption during peak demand, ensuring a stable grid and facilitating the integration of more renewable energy.

A notable example is Texas, where Bitcoin miners helped avoid the construction of new gas peaker plants, saving the state a staggering $18 billion. This not only prevented the need for additional fossil fuel infrastructure but also allowed for a more renewable-friendly grid, further demonstrating the positive Bitcoin energy impact on both the economy and the environment.

Conclusion

While Bitcoin’s energy consumption is substantial, it is essential to consider the broader context. Bitcoin mining can drive investment in renewable energy, provide grid stability, and offer financial solutions in regions with unstable currencies. By focusing on sustainable practices and technological innovation, Bitcoin can play a pivotal role in the global energy transition without compromising environmental priorities.

While critics focus on Bitcoin’s energy consumption, few realize how it is already contributing to sustainability and financial inclusion. Here are five surprising ways Bitcoin is making a positive impact around the world.

Bitcoin: A Hidden Ally for a Greener and Fairer World?

What if Bitcoin was an opportunity for a more sustainable world rather than a threat?

While Bitcoin is often criticized for its energy consumption, few realize how it is actually helping communities and the environment in unexpected ways. Here are five surprising stories where Bitcoin has been a force for good.

- Mining Bitcoin to Heat Norwegian Homes 🇳🇴

In Norway, Bitcoin mining farms are recycling their excess heat to warm homes and greenhouses. Instead of wasting energy, the process is turned into a sustainable heat source, reducing overall energy consumption. (CoinDesk)

- Bitcoin and Renewable Energy in Africa 🌍

Projects like Gridless in Africa utilize excess hydroelectric power to mine Bitcoin, making rural energy projects financially viable. This innovation brings electricity to remote villages that would otherwise remain in the dark. (Gridless)

- Bitcoin Revives Ocean Thermal Energy Conversion (OTEC) 🌊

OTEC, a renewable energy technology abandoned in the 1980s, is being revived by OceanBit using Bitcoin mining. By acting as a mobile energy buyer, Bitcoin mining makes OTEC research financially viable, unlocking a new source of baseload renewable energy. (Daniel Batten)

- Bitcoin Mining Heats Dutch Greenhouses 🇳🇱

In the Netherlands, Bitcoin Brabant, led by Bert de Groot, uses solar-powered Bitcoin mining to heat greenhouses, reducing reliance on natural gas. This innovation helps decarbonize horticulture and has the potential to scale across the industry. (Daniel Batten)

Bitcoin is far from just an energy-consuming network—it’s a tool that is reshaping financial freedom and sustainability in unexpected ways. So, is Bitcoin a real threat, or an underappreciated ally in building a better world?

Sources & References

- MDPI.com – Comparative analysis of Bitcoin vs. Gold mining energy consumption

- Grand Angle Crypto – Voilà ce qui va pousser Bitcoin à plusieurs millions € !

- Digiconomist – Bitcoin Energy Consumption Index

- University Of Cambridge – Cambridge Bitcoin Electricity Consumption Index

- Grand Angle Crypto – Bitcoin : une contre-intuitive au changement climatique (Alexandre Stachtenko)

- Batcoinz – Bitcoin By Energy Source

- CoinShare – Mining Report 2024

- Alexandre Stachtchenko – Bitcoin : une solution contre-intuitive au changement climatique

- Grand Angle Crypto – Un prince belge et l’Indiana Jones du #Bitcoin !

- For a deeper understanding of the Virunga National Park project and its impact, consider watching the following video – The Miracle of Bitcoin in Virunga – Sébastien Gouspillou

- Dari – How Bitcoin mining stabilized the grid, saved Texans $18 billion, and earned the ire of Berkshire Hathaway Energy

- Linkedin (Daniel Batten) – Why Bitcoin Mining is Tier-1 Climate Action

- Asic Jungle – The impact of Bitcoin halving on Asic Prices : What minors and investors need to know

Get in touchConnect with Us for Expert Blockchain Solutions

We’re here to answer your questions and help bring your blockchain projects to life. Reach out to us for expert guidance and a free project estimate tailored to your needs.

Phone

+32 498 25 72 34

Location

49A Saint-Marc,5003, Namur, Belgium

Social network

Get in Touch

© 2025 BE Blockchain. All rights reserved.